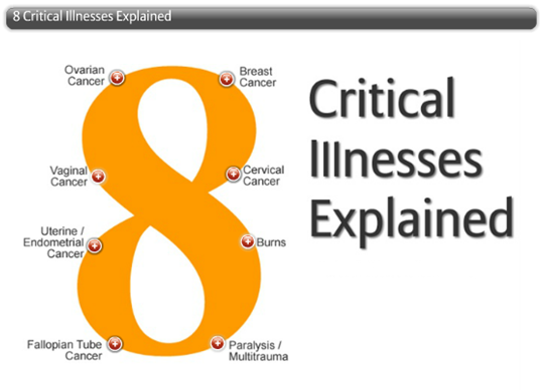

Bajaj Allianz's Women Specific Critical Illness Plan; She cares for everyone..... We care for her. This is a women-specific Critical Illness Insurance scheme that provides you protection against the risk of 8 critical illnesses. It gives you the security of knowing that a guaranteed cash sum will be paid in case you are diagnosed with a life-threatening illness.

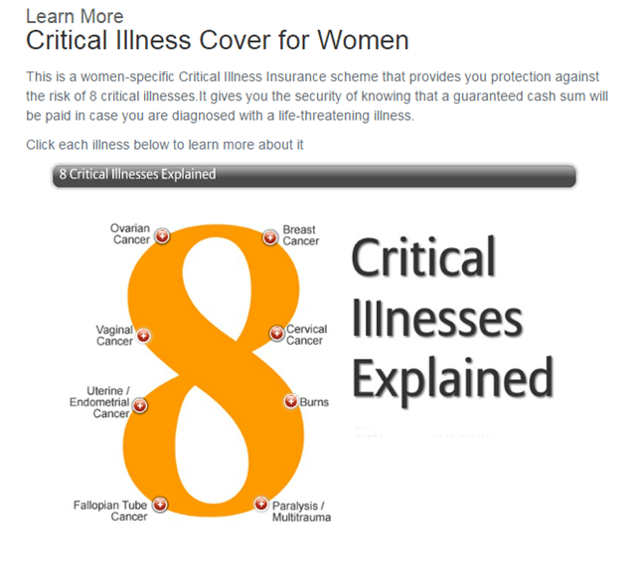

Critical Illness Cover for Women

This is a women-specific Critical Illness Insurance scheme that provides you protection against the risk of 8 critical illnesses. It gives you the security of knowing that a guaranteed cash sum will be paid in case you are diagnosed with a life-threatening illness.

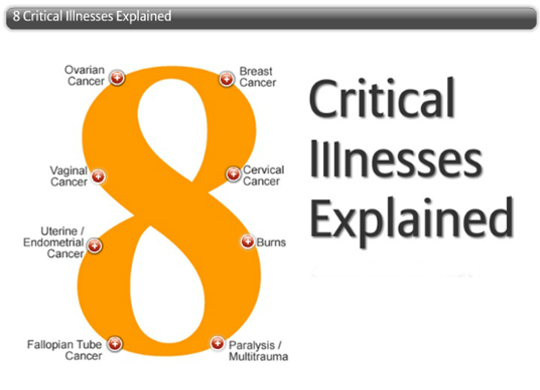

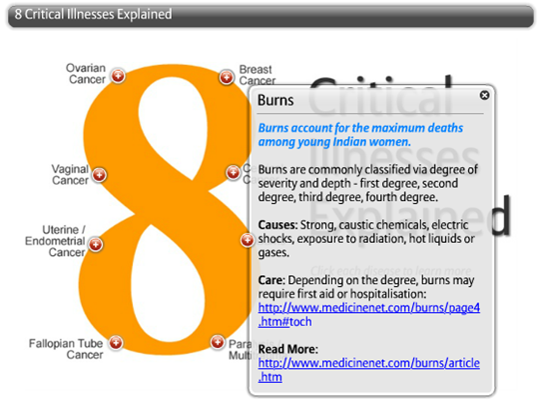

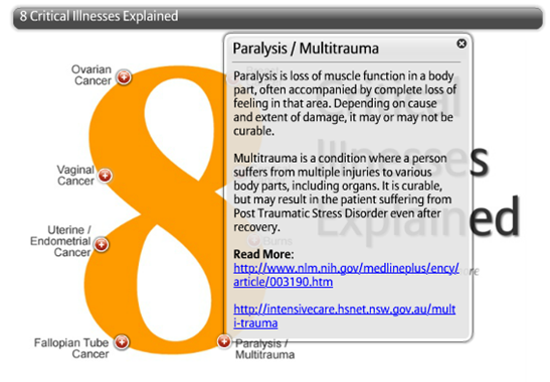

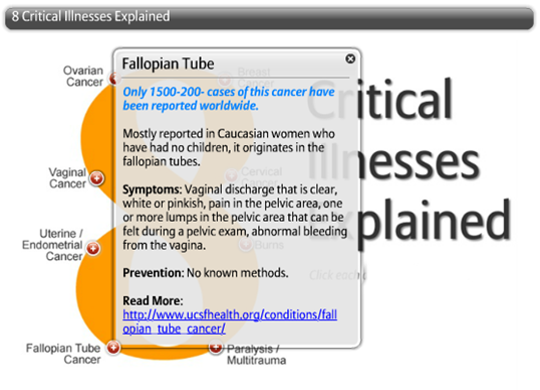

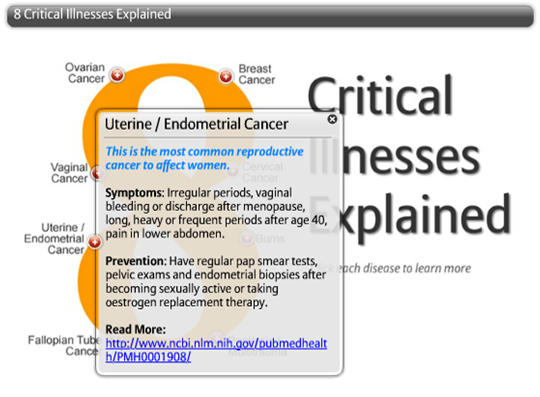

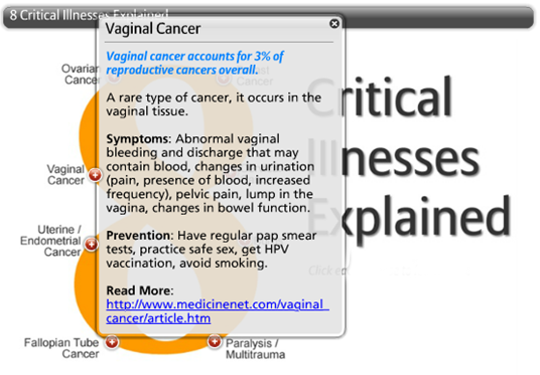

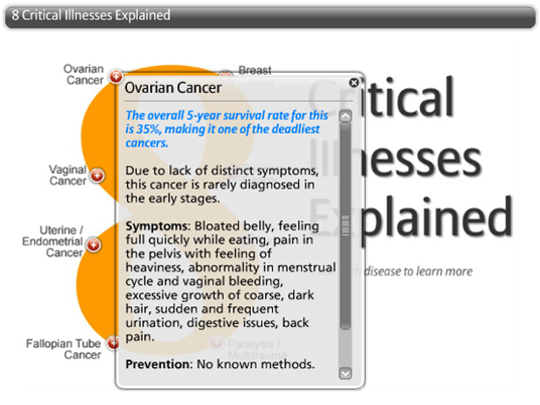

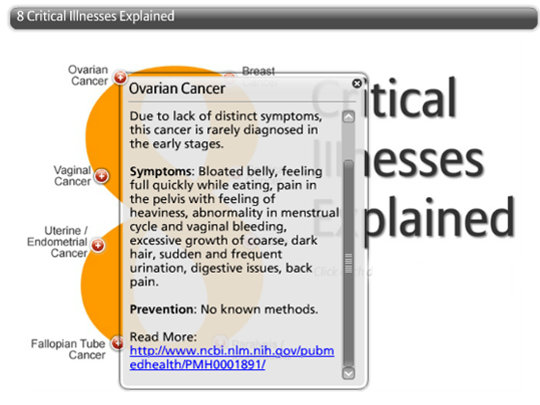

The 8 Life-threatening, Critical Illness, for women is: Breast Cancer, Cervical cancer, Burns, Paralysis / multi trauma, Fallopian tube Cancer, Uterine Endometrial Cancer, Vaginal Cancer, and Ovarian Cancer.

That's not all. There are many Additional Benefits, see next column... Creating awareness.

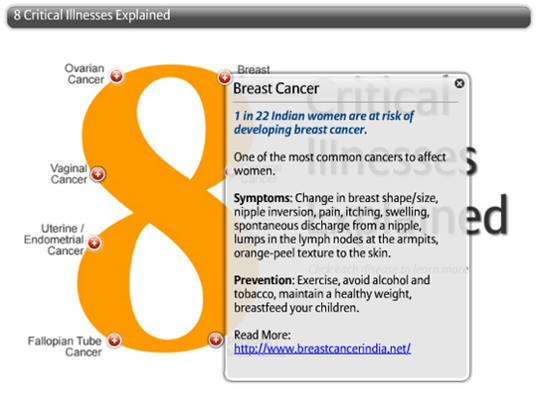

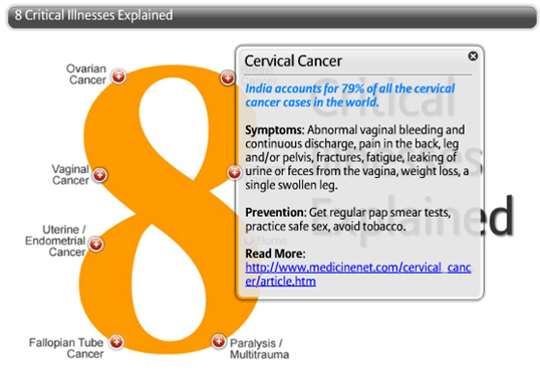

We feel users of this web page should be aware and know abou the said critical illness.

We give belowsome of the reference links which explains aboutthe said illness.

We are not responsible for the content and materials in the refered links.

You may click the links for more details:

Breast Cancer: http://www.breastcancerindia.net/

Cervical Cancer: http://www.medicinenet.com/

cervical_cancer/article.htm

Burns: http://www.medicinenet.com/

burns/article.htm

Paralysis: http://www.nlm.nih.gov/

medlineplus/ency/article/003190.htm

Multi-trauma: http://intensivecare.hsnet.nsw.gov.au

/multi-trauma

Fallopian tube cancer: http://www.ucsfhealth.org/

conditions/fallopian_tube_cancer/

Uteriene Cancer: : http://www.ncbi.nlm.nih.gov/

pubmedhealth/PMHT0023667/

Veginal cancer: http://www.medicinenet.com/

vaginal_cancer/article.htm

Overian Cancer: http://www.ncbi.nlm.nih.gov/

pubmedhealth/PMH0001891/

Search this web site:

Additional Benefits

A. Congenital Disability Benefit (50% of Sum insured)

An amount equal to 50% of the sum assured will be payable under the plan on the birth of the child with any one or more of the Congenital Disabilities listed below and the child survives 30 days from the date of diagnosis. This benefit will be available for first two children only and will not be available if the birth of the child occurs after the proposer attains the age of 40 years.

read more...

B. Children Education Bonus:

In the event of a Claim being admissible under Section I (Critical Illness) the policy will pay Children's Education Bonus for future education of the children (one or more). The amount payable under this section would be restricted to Rs 25000/- for one or more child put together.

read more...

C. Loss of Job:

In the event of the insured person losing her job within a period of 3 months of the date of diagnosis of any of the Critical Illness as covered in the policy, the policy will pay an amount of Rs 25,000/- towards loss of employment. For a claim to be admissible under this section the claim under Section. I should be admissible.

o Specific Exclusions for loss of Job: Loss of Job due to voluntary resignation from service is excluded.

read more...

No Fine-print! What is not Covered Explained in Broad-print

The full range of benefits available and the exclusions that apply under the policy is detailed in the policy document. A copy of the policy wording is available on request, and will be sent to you upon the acceptance of your proposal.( you may download the proposal form, here). If you have any questions, please contact us or your insurance advisor.

Not Sure?

Call us -BAGIC, now at 020-66495000 and we at BAGIC will explain all the medical terms to you in plain and simple language. All our BAGIC representatives are women. They will consult a resident female doctor in case your queries are not resolved.

read more...

D. Exclusions:

Despite the extensive coverage offered by this policy, there are a few exclusions that you need to know about. We, BAGIC suggest you read this section carefully before making your purchase decision. If you have any queries, please call us, BAGIC at: 020-66495000. Our, BAGIC female representatives will help you understand the terminologies better. Our team of female doctors will answer any in-depth queries you may have.

read more...

This Is Not Mediclaim:

Unlike a hospitalization or mediclaim cover, under a critical illness cover the insurer makes a lump sum cash payment on diagnosis of any of the critical illnesses listed in the insurance policy. You do not have to get hospitalized or show medical bills to claim under this policy.

The claim is payable the moment any critical illness is diagnosed and none of the exclusions under the policy apply.

Note: Please read the exclusions section carefully.

read more...

click a title to download

click a title to download

Insurance is the subject matter of the solicitation.

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/ FRAUDULENT OFFERS

- IRDA clarifies to public that IRDA or its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums.

- IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.

This website content is not a brochure and only gives the salient features of the plan. For more details on risk factors, terms and conditions please read the sales brochure carefully before concluding a sale.